Overview

- Quick link to invoicing

- Here we look at invoices

- Here we look at Tax rates

- Here we look at pricing models

Invoices and Driver pay

1

Cab9 requires certain information to populate your invoices.

Default Models

- Default pricing model – this is the default pricing that is applied to bookings unless another specified.

- Default payment model – this is the default pay that is applied to drivers unless another specified.

2

Tax Rates

- Default Tax – For VAT registered entities this will be set to VAT

- Default Tax (cash bookings) – This is usually set to NO VAT

- Default Tax (card bookings) – This is usually set to NO VAT

3

Registration details

- Registration Number – Your Company Registration number (if you have one)

- Vat Number – If you have one

4

Invoice Details

- Invoice payment advice – Free text field for any payment advice you may wish to add

- Invoice terms (days) – This is used to calculate the due date of any invoices from the tax date of issuance.

5

Bank details

For your clients to make BACS payments to you we need to provide details to appear in the invoice

- Bank Name

- Account Number

- Sort Code

- IBAN Number (optional)

- BIC Code (optional)

6

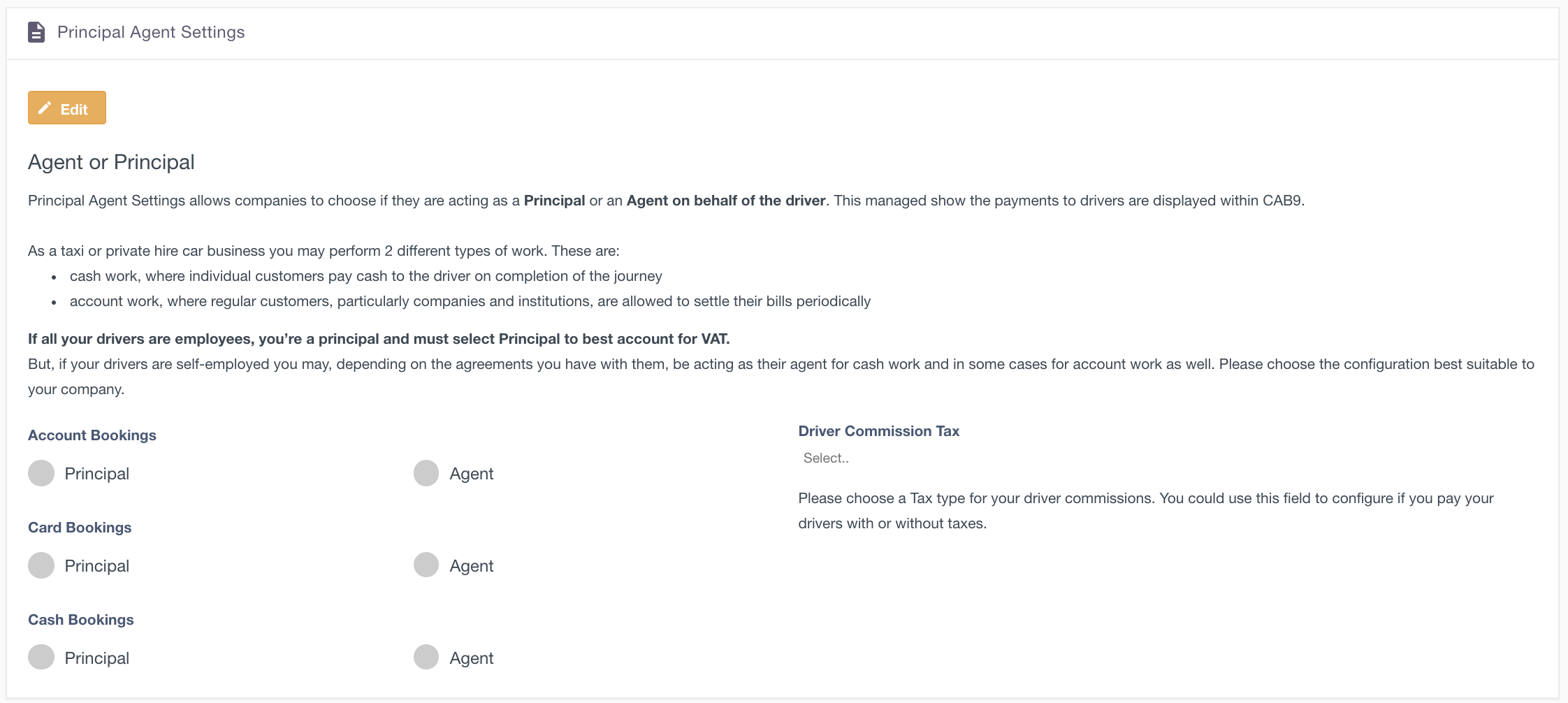

Agent / Principle Settings

Use this section to define whether you are acting as an agent or principle for certain boking types.

If you are unsure about this bit, talk to your accountant!

Next Steps

- Here are more articles on admin